how much is inheritance tax in wv

Six states collect a state inheritance tax as of 2021 and one of themMarylandcollects an estate tax as well. So the answer is 0.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

There is no federal inheritance tax but there is a federal estate tax.

. Like most states there is no West Virginia inheritance tax. Effective Jan 1 2013 if Congress does nothing about the federal estate tax then the tax will return to the status that existed on Jan 1 2000 which would make the estate tax equal to the federal tax credit given against payment of state estate tax. However state residents must remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1118 million.

West Virginia Inheritance and Gift Tax. Pennsylvania for instance has an inheritance tax that applies to any assets left by someone living in the state even if the inheritor lives out of state. Charitable and nonprofit organizations dont pay a tax if the amount is less than 500 but 10 percent of anything over the amount.

West Virginia collects neither an estate tax nor an inheritance tax. Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance. If you are a spouse child parent stepchild or grandchild youll pay no inheritance tax as the entire amount is exempt.

There is no inheritance tax in West Virginia. Inheritance isnt subject to income tax theres no federal inheritance tax and any estate tax is owed by the estate not you. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000.

Other heirs pay 15 percent tax as a flat rate on all inheritance received. In 2021 federal estate tax generally applies to assets over 117 million. Each state has different estate tax laws but the federal government limits how much estate tax is collected.

Washington has the highest estate tax at 20 applied to the portion of an estates value greater than 11193000. However you could owe inheritance tax in a different state if someone living there leaves you property or assets. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. There are circumstances that require you to pay tax on your inheritance but theyre the exception rather than the rule. West Virginia collects neither an estate tax nor an inheritance tax.

There can be two kinds of death taxes inheritance taxes and estate taxes. All Major Categories Covered. The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption.

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc States With An Inheritance Tax Recently Updated For 2020 Tsd393 State Wv Us Taxrev Taxdoc Tsd States With An Inheritance Tax Recently Updated For 2020 States With No Estate Tax Or Inheritance Tax Plan Where You Die States With An Inheritance Tax Recently Updated For. Ad The Leading Online Publisher of National and State-specific Probate Legal Documents. WV has no inheritance or estate tax.

Inheritance tax rates depend on the beneficiarys relation to the deceased and. However state residents must remember to take into account the federal. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

That means if you inherit property either real property personal property or intangible property like financial accounts or cash you will not have to pay an inheritance tax in WV West Virginia inheritance tax on the value of the inherited property. If you are a sibling or childs spouse you dont pay taxes on inheritance under 25000. 15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt from tax.

Property owned jointly between spouses is exempt from inheritance tax. Select Popular Legal Forms Packages of Any Category. Anyone else pays inheritance tax of 0 16 but in New Jersey domestic partners are exempt too.

Any estate worth more than 118 million is subject to estate tax and the amount taken out goes on a sliding scale depending on how much more than 118 million the estate is worth. 45 percent on transfers to direct descendants and lineal heirs. Whether you inherit one dollar or a million dollars its unlikely youll have to pay tax on it.

So the answer is 0.

What Is A Bypass Trust In An Estate Plan

A Guide To West Virginia Inheritance Laws

A Guide To West Virginia Inheritance Laws

West Virginia Estate Tax Everything You Need To Know Smartasset

/usa--west-virginia--charleston--kanawha-river-and-skyline--dusk-CA22372-5a5353d29802070037bb6e5a.jpg)

Dying With No Last Will And Testament In West Virginia

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

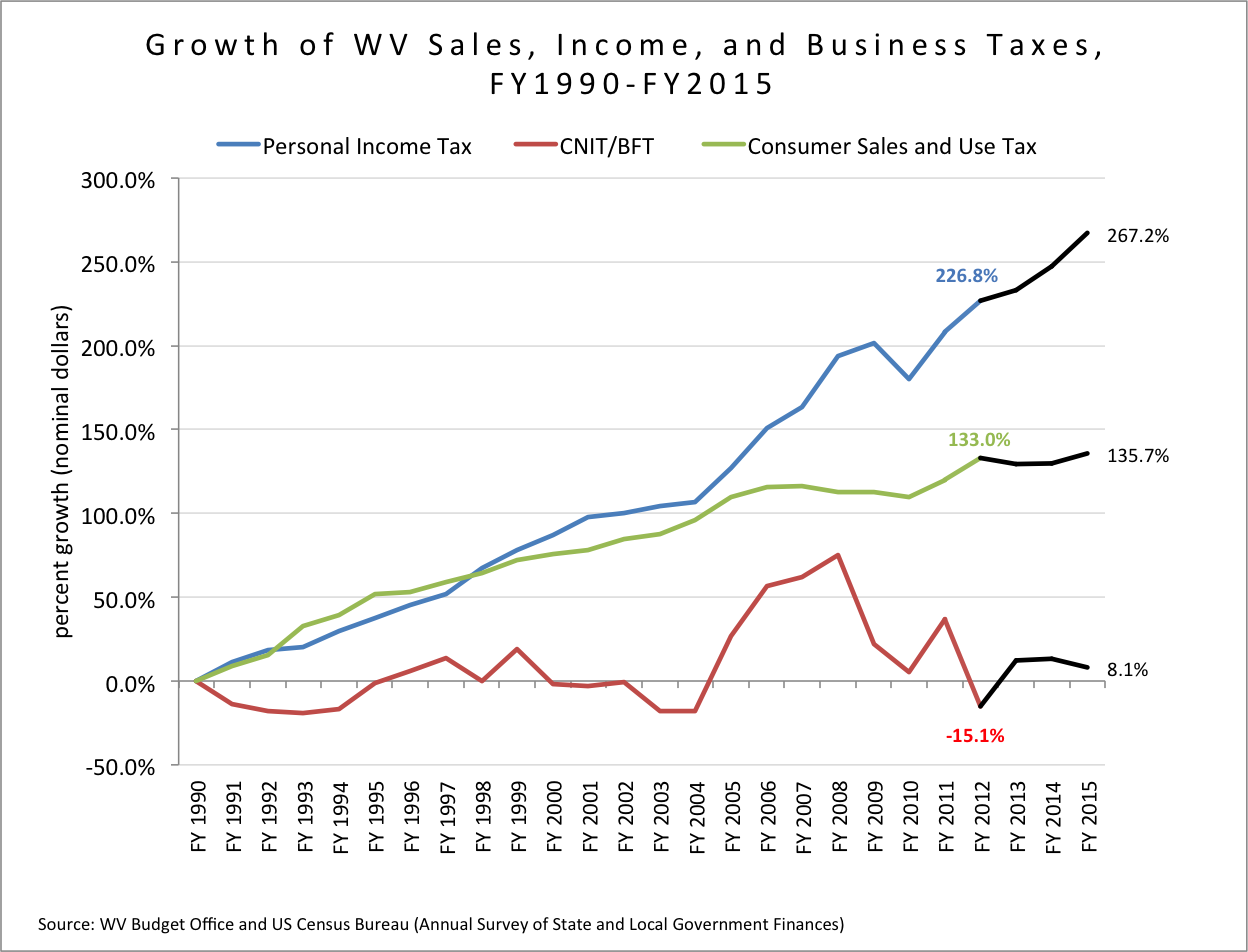

Wv Budget Gap A Revenue Problem Part 2 West Virginia Center On Budget Policy

States With No Estate Tax Or Inheritance Tax Plan Where You Die

West Virginia Health Legal And End Of Life Resources Everplans

West Virginia Income Tax Calculator Smartasset

Historical West Virginia Tax Policy Information Ballotpedia

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Us Inheritance Tax Leave Property For Children List Of 13 States And Territories That Impose Inheritance Tax In The United States 2020 Edition American Life Insurance Guide

A Guide To West Virginia Inheritance Laws

West Virginia Income Tax Calculator Smartasset

West Virginia Estate Tax Everything You Need To Know Smartasset

West Virginia Estate Tax Everything You Need To Know Smartasset