tax on venmo cash app

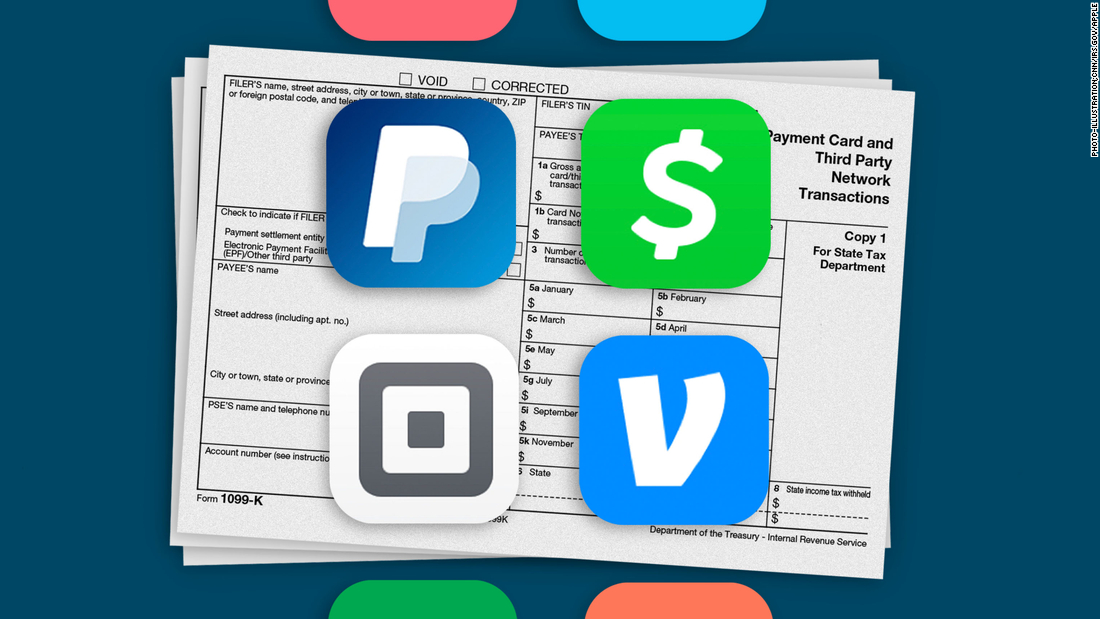

1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service. For Venmo Cash App and other users this may sound like a new taxbut its merely a tax reporting change to the existing tax law.

Will Users Pay Taxes On Venmo Cash App Transactions It Depends

Venmo users are asking if Venmo are transactions taxed.

. Why things changed The changes to tax laws affecting cash apps were passed as part of the American Rescue. The new rule which took effect. Starting in 2022 a.

This new rule does not apply to payments received for personal expenses. Anyone who receives at least 600 in payments for goods and services through Venmo or any other payment app can expect to receive a Form 1099-K. Theres a lot of chatter online about a new tax reporting requirement that applies to users of third-party payment processers like Venmo PayPal Zelle and Cash App.

Both allow you to send and receive money from your smartphone. As the reporting requirements changed many Cash app users panicked. Under the American Rescue Plan a provision went into effect at the beginning of this year that directs third-party payment processers to report transactions received for goods or services totaling over.

Cash App and Venmo are widely used peer-to-peer P2P mobile payment apps. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue Service. Under the prior law the IRS required payment.

This will change the way that you file your taxes next year. PayPal does not allow trading if you are not verified. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600.

The new cash app regulation put in place under the American Rescue Plan seems intimidating. The IRS is cracking down on the apps to make sure everyone is paying their fair share of taxes. And for many people in 2023 life will bring a 1099-K form to ensure certain transactions on apps like PayPal Venmo and Cash App are taxed appropriately.

After account verification this limit may increase up to 4999. Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle Cash App or Venmo. Instead reporting requirements for third-party payment services and apps such as Venmo and PayPal for taxes have changed.

An FAQ from the IRS is available here. Through 2021 the law required third-party settlement providers to report to the IRS any user who received at least 200 commercial transactions totaling at least 20000. New Cash App Tax Reporting for Payments 600 or more.

VERIFY previously reported on the change in September when social media users were criticizing the IRS and the Biden administration for. The number of transactions is no longer relevant. Form 1099-K is a tax form sent to users that may include both taxable and nontaxable income sources.

By Tim Fitzsimons. Venmo CashApp and other third-party apps to report payments of 600 or more to the IRS. Once verified you can trade up to 60000 limited to.

How the new cash app regulations work. The Internal Revenue Service is cracking down on people who underreport earnings received through digital payment apps such as PayPal Venmo Cash App Zelle and others. Rather small business owners independent contractors and those with a.

Currently cash apps are required to send you 1099 forms for transactions on cash apps that exceed a. Its now just one requirement 600. Churches and ministries everywhere regularly use apps like Venmo Paypal and Cash App to easily receive charitable funds from their donors and members.

January 19 2022. This is due to the new tax reporting requirement put on third-party settlement organizations TPSOs such as PayPal and Cash App as part of the American Rescue Plan Act that was signed into. Here are some details on what Venmo Cash App and other payment app users need to know.

Starting this year the IRS is legally requiring all transactions totaling over 600 dollars on third party apps like CashApp and Venmo to be reported. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. The change in tax law put into effect by the American Rescue Plan during the Covid requires your gross income to be reported to the IRS if it totals more than 600.

Previously payment processors were only required to issue a Form 1099-K if someone received 20000 in aggregate payments and 200 transactions. Payment apps like Venmo Zelle Cash App and. While Venmo is required to send this form.

As for shipping limits in the case of Venmo the limit is set at 299. Payments of 600 or more through third-party payment networks like Venmo Cash App or Zelle will now be reported to the IRS. Mendelson Clinical Assistant Professor of Accounting at UAH says Theres no telling how many.

Fee-free tax filing through Cash App Taxes. A new tax law went into effect that requires third-party payment processors to report business transactions that meet certain new thresholds to the IRS. The Bottom Line On Zelle PayPal Venmo Taxes.

If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your transactions. However its important to understand that this isnt a new tax.

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Tax Changes Coming For Cash App Transactions

Cash App Vs Venmo How They Compare Gobankingrates

Does The Irs Want To Tax Your Venmo Not Exactly

New Tax Law Venmo Cash App To Report Business Transactions Over 600 Wrvo Public Media

:max_bytes(150000):strip_icc()/how-safe-venmo-and-why-it-free_FINAL-d6b7c0672d534208a05d1d53ae0cd915.png)

How Safe Is Venmo And What Are Its Fees

Venmo Paypal And Zelle New Tax Reporting Rules

Venmo Cashapp And Other Payment Apps Face New Tax Reporting Rule Cnn Business

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wsiltv Com

Qod Top Financial App In The App Store Venmo Cash App Or Paypal Blog

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You 6abc Philadelphia

Tax Law Changes Could Affect Paypal Venmo And Cash App Users

9 Venmo Settings You Should Change Right Now To Protect Your Privacy Cnet

Cash App Vs Venmo Which Is For You

New Tax Rule Requires Paypal Venmo Cash App To Report Annual Business Payments Exceeding 600

Square To Buy Credit Karma Tax Biz For Cash App Expansion

No Venmo Isn T Going To Tax You If You Receive More Than Us 600 Tech