does td ameritrade provide tax documents

You must send Copies A of. Does TD Ameritrade provide tax documents.

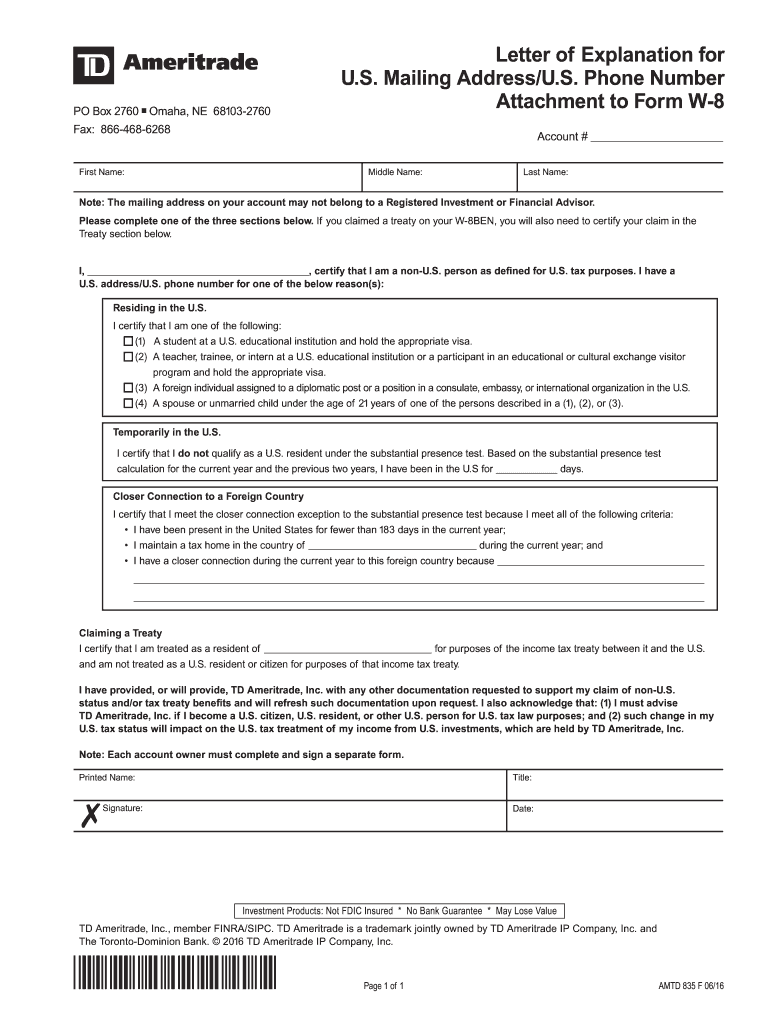

Irs Form W 8ben Td Ameritrade 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

Answer Simple Questions About Your Life And We Do The Rest.

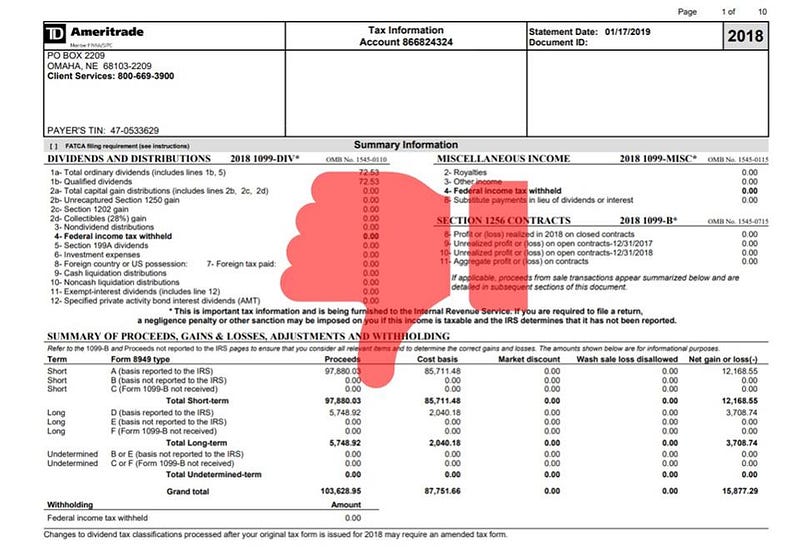

. Do I need to report anything on my tax return if I havent withdrawn any funds from the account. TD Ameritrade provides a downloadable tax exchange format file containing your realized gain and loss information. Ad Free tax support and direct deposit.

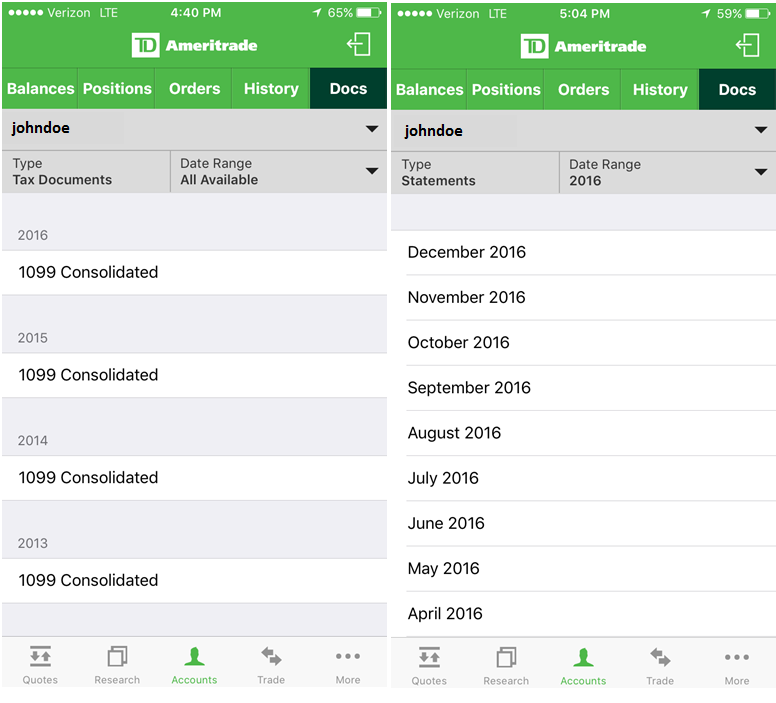

Be directed to your tax advisor. TD Ameritrade is not responsible for payment reallocations that result in the issue of a corrected Consolidated Form 1099 and will not be held liable for any fees incurred for the refiling of a tax. The TD Ameritrade Mobile app now has up to 7 years of tax documents and 10 years of statements available from your iOS or Android device.

I recently opened an account with TD Ameritrade. Do you send 1099 forms to IRS. Continue your return in TurboTax Online.

No Tax Knowledge Needed. You can import your 1099-B from TD Ameritrade because it participates in the TurboTax Partner program. Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

If your return isnt open. Retrieve your tax documents or. TD Ameritrade wont report tax-exempt OID for non.

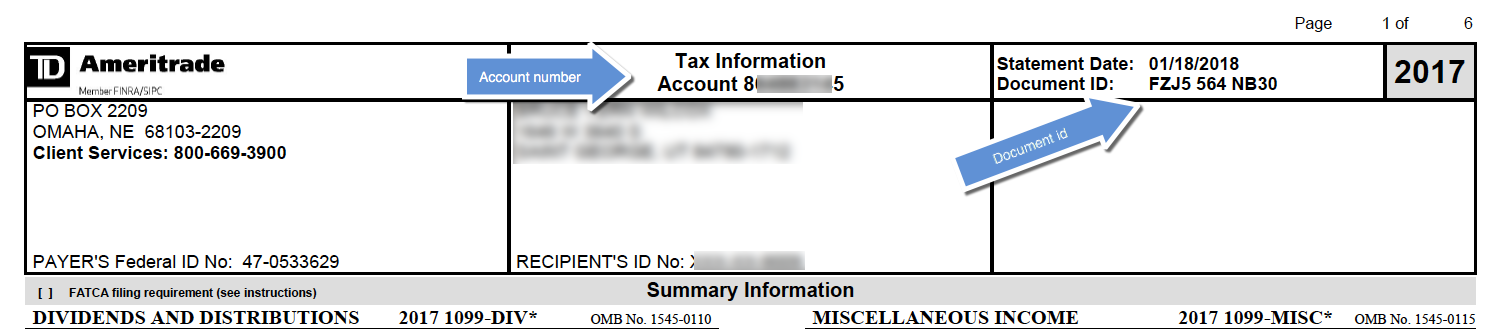

Reports reclassified income not captured on Consolidated 1099 forms to be issued in mid-February 2017 that was reported to TD Ameritrade between 292016 and. Answer Simple Questions About Your Life And We Do The Rest. Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

TD Ameritrade does not make recommendations or determine the suitability of any security strategy or course of action for you through the use of TD Ameritrades trading tools. You should have received your 1099 and 1098 forms. Start filing for free online now.

Your tax forms are mailed by February 1 st. You must enter the gain or. Get the Answers You Need Online.

Ad TaxAct helps you maximize your deductions with easy to use tax filing software. If you hold covered securities with tax-exempt original issue discount OID it will now be reported to the IRS on Form 1099-OID. Over 85 million taxes filed with TaxAct.

Ad File 1040ez Free today for a faster refund. TD Ameritrade clients can sign up for electronic delivery of tax documents and stop receiving paper documents. 1099-INT forms are only sent out if the interest earned is at least 10.

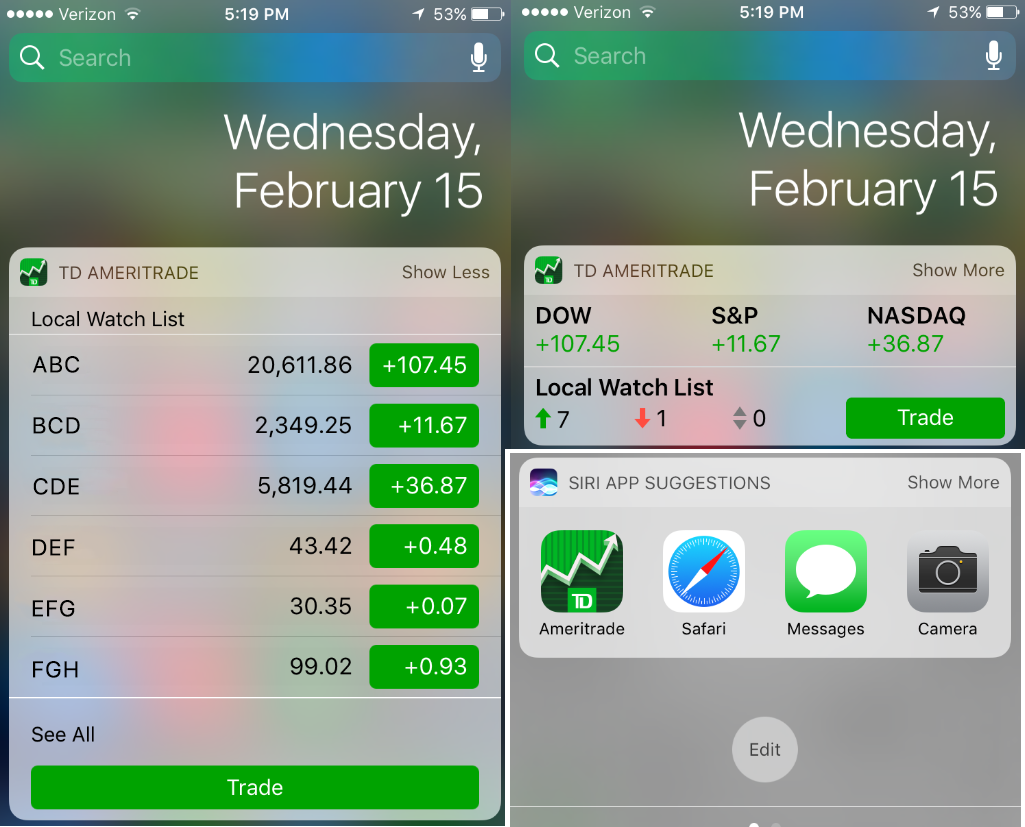

You should be able to access US. TD Ameritrade stores up to seven years of tax documents in your account and you can access these materials 24 hours a day. Tax Tools Tax Form Filing Dates TD Ameritrade Taxes Make tax season a little less taxing with these tax form filing dates The key to filing your taxes is being prepared.

Ad Increased Volatility has Increased Questions. Does TD Ameritrade provide tax documents. Download this file and submit it for processing by our program.

Tax filers with earnings up to 10 will be provided a 1099-DIV form from TD Ameritrade along with a consolidated 1099 forms from. No Tax Knowledge Needed. TD Ameritrade stores up to seven years of tax documents in your account and you can access these materials 24 hours a day wherever you are.

TD Ameritrade stores up to seven years of tax documents in your account and you can access these materials 24 hours a day.

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker

Tax Season And More Made Simpler With The Td Amerit Ticker Tape

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Td Ameritrade Ofx Import Instructions

Logo Td Ameritrade Institutional

Find Your 1099 On Td Ameritrade Website Tutorial Youtube

Get Real Time Tax Document Alerts Ticker Tape

Tax Season And More Made Simpler With The Td Amerit Ticker Tape

It S Harvest Time Potentially Grow Your Savings Usin Ticker Tape